St.Johnstone FC accounts analysis 2014

“with the increases in wages for players we signed up again, I’m not in a position to make an offer for any player. I would hope it changes. I spoke to the chairman again this morning and he reiterated that we can’t do anything.” – T Wright July 8th

Following the most successful season in Saints history, the above statement made in the summer by manager Tommy Wright, combined with the lack of investment in new signings has made chairman Steve Brown the target of some isolated criticism. Therefore, the accounts to the end of May 2014 should make interesting reading into how ‘skint’ St.Johnstone are.

Thanks to (two) Saints shareholders I have the accounts for analysis ahead of their publication on companies house.

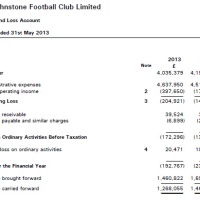

The headline news is of course that Saints have made a year end profit of £258,861, wiping out last years loss of £192,000. Even more impressive is turnover is at (at least I think it is) a record high, of £5,177,267 – 25% up on the previous year.

That immediately raises the question on how on earth can we not afford to sign anyone? Well, maybe that can be answered by the fact that expenses (which include wages) are at just over £5million, an increase of almost 10% on last year. What would be worrying the administrators at McDiarmid would be what would have happened if income had been at 2013 levels? Saints would have been staring at a seven figure loss, although I imagine a lot of the added expenditure has come from:

- European travel

- Player bonus’ for cup wins and European qualification.

- Additional loan signings made last Xmas to cover for injured players.

I suspect the Saints budget is based on a 2013 turnover, so by reducing costs by £200,000 (or approximately 3 full time players), the books can be balanced. Certainly on the evidence produced in these accounts, this would make financial, if not sporting, sense.

Going into the accounts, they start with the chairman’s statement:

To say that season 2013/2014 was a memorable one for the club would be something of an understatement. When I wrote to you last year we had qualified for our second successive European campaign and of course that Europa League competition brought fantastic away wins in Norway and Belarus – remarkable achievements for a squad with little European experience.

Buoyed by that success, the players went on to comfortably secure a third successive top six finish in the SPFL Premiership – no mean feat. However, it was the domestic cup competitions which set last season aside from others. A League Cup semi final was creditworthy but of course it was our achievement in winning the Scottish Cup which will etch season 2013/2014 firmly into the record books.

The whole experience of that day and the parade which followed on the Sunday will live long in the memory of everyone who was there or who witnessed it in some way.

I was always confident that Tommy Wright’s promotion to the role of manager in June 2013 was the right one to make and while that has proved to be the case, I could not have envisaged the level of success we would have achieved under his management. It is a great credit to not only Tommy but also his staff and players.

It is that domestic cup success, particularly in the Scottish Cup, that has allowed us to report a profit for the year ended of £258,861.

Shareholders will be aware that to post a profit has proved an elusive aim in recent years and I undertake to ensure that this unexpected windfall is used wisely for the future benefit of the club – necessary upgrading to the floodlighting to meet the increasing requirements of live television broadcasting and a new surface for our much used fourteen year old all-weather pitch will be key investments. This undertaking will cost in the region of £200,000.

The amalgamation of the SPL and SFL which brought about a redistribution of league fees from the Premiership to the other three divisions, coupled with another season without a league sponsor makes for further challenging times ahead.

2014 marks for the 25th anniversary of our time at McDiarmid Park but the realisation that our home ground is no longer a new stadium brings with it the inevitable fact that significant amount of finance is having to be invested into ongoing maintenance of the stadium and surrounding grounds and such investment will have to continue to be made as we endeavour to ensure that the stadium meets the safety and comfort requirements of supporters and other visitors using our facilities.

Any revenue generated from our non football income stream continues to be absolutely vital to the financial well being of the club – around 25% of the clubs turnover relates to such activity. Again, times are challenging in this respect and much hard work has to be done to retain existing conference & social event business whilst gaining new customers in these fields.

Changes to how we provide our customers with such business have been and will continue to be made to drive up the efficiency and profitability in this vital area. The success in bringing national silverware to Perth has given us a unique opportunity to promote the Club and encourage a new generation of supporters and the extensive programme of visits around Perth & Kinross Schools and local businesses proved highly beneficial in that respect. That work will continue in the months ahead.

Our ‘12s and unders go free’ initiative continues to be a cornerstone of my determination to get local children supporting their local team – we had 1,400 kids at the Europa League game against Minsk, which I’m sure was a fantastic experience for them. I also hope that the decision to keep season tickets and match day admission prices unchanged this season coupled with a change to our pricing policy in the Ormond Family Stand will encourage as many people as possible to come along and support the team.

Hopefully, also of assistance in getting more kids supporting Saints, is the sharp increase in the number of boys from Perth & Kinross being identified as good enough to be part of our Youth Academy structure under Alistair Stevenson.

The on-going development of the Academy pleases me greatly and the inaugural Youth Academy Presentation Night at Perth Concert Hall in April was a personal highlight of last season. There is no doubt that this is the way forward for the club and to that end, as indicated above, I have committed to replacing the existing all-weather pitch with a top quality surface in the coming autumn and this will provide the first team, the Youth Academy and the community of Perth with a fantastic facility.

These are great times to be a St Johnstone Supporter. I and my fellow directors will continue to provide Tommy with all the available funding we can reasonably afford to give Tommy and his staff the best chance of maintaining these good days. S Brown.

Following on from the statement, and the usual statutory auditor requirements we move onto the first part of the accounts, the Profit and Loss account:

As can bee seen turnover is up, and a loss has turned into a decent profit. However, expenses (Administrative expenses) are also massively up.

Next we move onto the balance sheet. As I have said in my previous analysis’ this is where the health of a company can really be seen.

Fixed assets are slightly up, and note 5 shows that £74,000 has been spent on fixed assets over the course of the year.

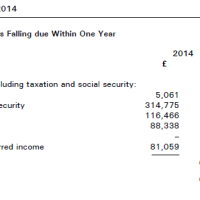

Debtors due shows cash still owed to Saints, which is down on last year, as is cash in the bank (down £50,000). However, these are more than offset by the creditors due (note 8) which is down over £400,000 from last year. As a result, the total assets of the club have increased from £1.5million to over £1.76million.

One thing to note is how basic the Saints accounts are – the profit/loss has translated almost 100% to the balance sheet – in stark contrast to certain other Scottish clubs who use financial trickery to disguise huge deficits.

Moving on we come to the fixed assets segment. Nothing out of the ordinary here, apart from a note that the stadium is NOT included in the fixed assets. This means the figure of what Saints are worth above (£1.76m) is actually artificially low as it does not take into account what McDiarmid Park is worth, either for current use, or future use. There is also land acquired in 1989 included in the fixed assets, however only at a value of £31500, the price paid in 1989. This land will be worth considerably more now.

So, there we are – a fairly straight forward set of accounts. They both show a good news story for saints, but also a cautionary tale that we cannot be lulled into spending more than we can afford. For those of us who have followed Saints through thick and thin we understand that our current standing in Scottish football is way above our station. We’ll enjoy it while we can – but when the honeymoon is over it is important that our rainy day fund has not been squandered on chasing an impossible dream.

Other operating income down from £397k to £73k. Any info as to what this represents? Huge decrease and quite worrying depending on the nature of this income

my guess is that they put this in last season as European income… they probably didn’t have a line on the accounts for that! Possibly they have since added one, but it is all a guess TBH!

Loss of Jehovas Income must have been significant

Would have thought that European Income would have been included partly in Turnover and that we would have treated last years Euro income in the same way as the previous year???

But as you say if there is no analysis then we are left guessing I quess.

Good article by the way.

Sorry can’t leave this alone but this might be loss of League sponsorship monies???

Hopefully a shareholder might be persuaded to enquire.

If anyone wants to send me to the AGM as their representative I will be sure to ask! 🙂 I doubt it is loss of sponsorship though as it is quite a few years since we had any!

I see you don’t monetize your blog, don’t waste your traffic,

you can earn extra cash every month because you’ve got high quality content.

If you want to know how to make extra $$$, search for: best adsense alternative Wrastain’s tools